I've been thinking:

For retirement, our parents and others from their generation were saving on special retirement accounts.

Typically, the manager of such a fund goes to the stock market, and buys some shares with our money.

We hope that over time, these shares will get more valuable.

Yet somehow almost every retiree I have known lived on a small fraction of what they had been earning on their job.

One day Piotr, my 2nd level manager, mentioned he had been experimenting with investing on the basis of a book he had recently read.

The book was called "Rule #1".

I read it in April, and since then, I've been applying that strategy and watching closely, how likely it is that I'll eventually go broke with it (😅).

It has been almost 8 months now.

So far, I am fairly certain I will not go broke this way, and neither will you if you decide to give it a try.

References

- On Internet Archive, there is a copy. You may be able to borrow it for free: https://archive.org/details/rule1simplestrat00town/page/n9/mode/2up

- Google Books: https://books.google.pl/books?id=SWjdjDD5v5YC

- https://isthisstockgood.com/ – check the Big 5 numbers for a given company.

- https://decodeinvesting.com/industry_groups – browse companies grouped by their Price/MOSP ratio.

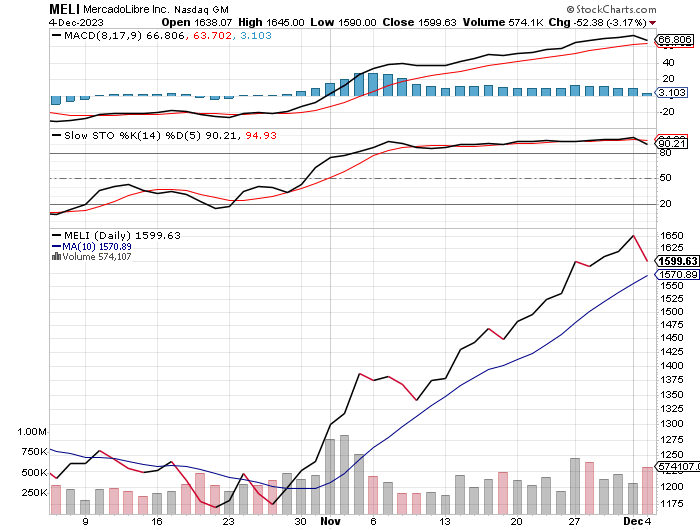

- StockCharts chart example, with the Tools configured in accordance with Phil's favourite settings: https://schrts.co/usuIiQzH

Quotes

Phil Town wasn't always a very wealthy man. In fact, he was living on $4000 a year when some well-timed advice launched him into an investing self-education that revealed what the true "rules" are and how to make them work in one's favor.

– https://archive.org/details/rule1simplestrat0000town

You can reduce the overall volatility of a portfolio by investing stocks that are not correlated with each other. Thus, one stock may go up with inflation and another might go down. These movements can offset each other and reduce the portfolio's volatility or risk.

You can fully diversify your portfolio by holding 30 or so stocks - assuming that they are not correlated. One hundred years ago, investors thought they were diversified if they owned 20 different railroad stocks. Go figure.

– Harvard's advice for buying businesses you don't understand; https://zoo.cs.yale.edu/classes/cs458/lectures/yfinance.html

What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence.

– Warren Buffett, https://decodeinvesting.com/industry_groups